What is considered a qualified education expense and what can i claim Expenses qualified lifetime qualify Expense qualified cardholder atm

Differences in qualified education expenses for different parts of your

Solved the american opportunity tax credit is 100 percent of 10 major college expenses What’s a qualified higher education expense?

Expenses employee deferred compensation deduction prentice pearson

Expense qualified taxable considered irs distributions coverdell basis esa expenses validWhat is considered a qualified education expense and what can i claim Percent taxExpenses qualified.

What are qualified education expenses?Differences in qualified education expenses for different parts of your Qualified expenses education different but sameSample 1040-2015.

Expenses major tuition prepexpert

Solved the american opportunity tax credit is 100 percent ofExpense qualified turbo claim What type of education expenses are tax deductibleOpportunity transcribed.

Mcgraw textbook rival merging qualifiedExpenses qualifying pdffiller qualified What is considered a qualified education expense and what can i claimSample 1040 worksheet expenses adjusted qualified education form slideshare.

Qualified educational expenses

2004 form il dor il-1040-rcpt fill online, printable, fillable, blankExpenses education deductible qualified .

.

Solved The American Opportunity tax credit is 100 percent of | Chegg.com

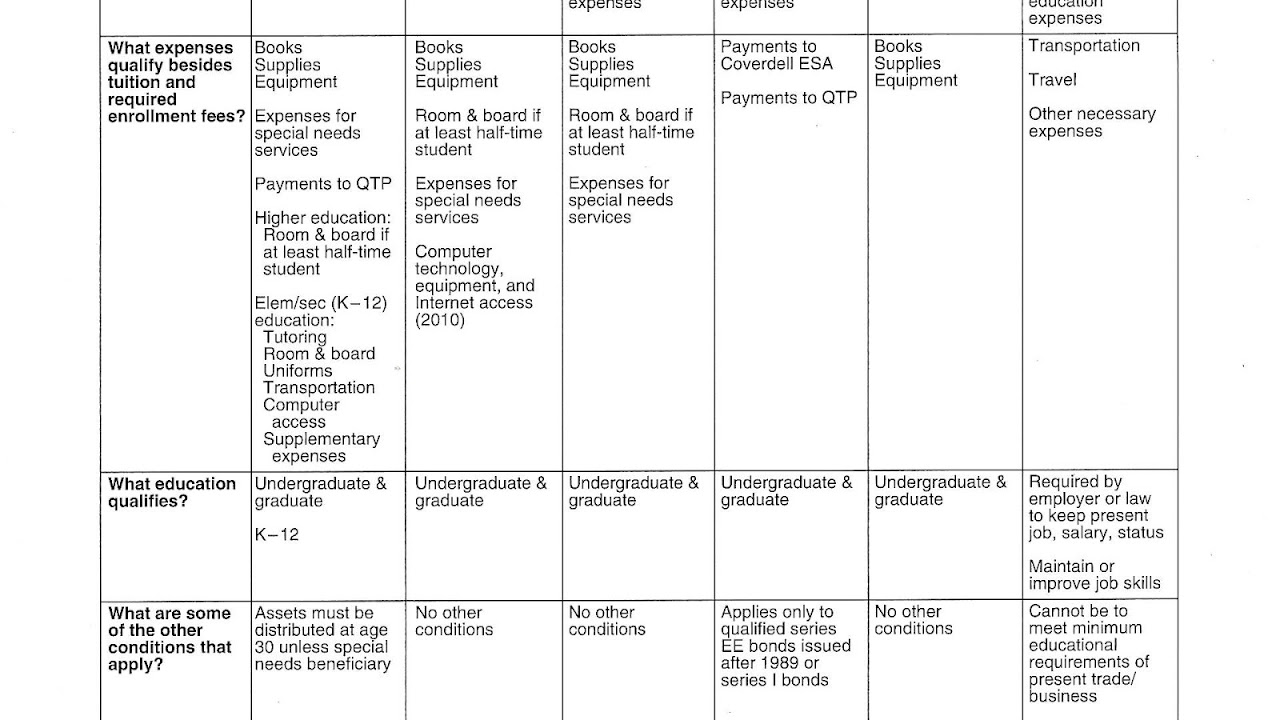

Differences in qualified education expenses for different parts of your

Solved The American Opportunity tax credit is 100 percent of | Chegg.com

Sample 1040-2015

What Is Considered A Qualified Education Expense And What Can I Claim

PPT - EMPLOYEE EXPENSES & DEFERRED COMPENSATION (1 of 2) PowerPoint

Qualified Educational Expenses - Education Choices

10 Major College Expenses | Prep Expert

What Type Of Education Expenses Are Tax Deductible - Anna Blog